Alternative

Investment Strategies

ALTERNATIVE – STRATEGIES

We continue to evolve, design, and launch new strategies, and products to adapt to developing market conditions, and deliver custom solutions for our clients. Our alternative product offerings include long/short equity hedge fund, multi-asset, private equity, and real assets (including commodities) strategies.

PRODUCTS

Delphin Multi-Asset Fund’s (DMAF)

The Delphin Multi-Asset Fund’s (DMAF) investment objective is to achieve long-term returns that exceed the annual performance of the 3-Month U.S. Treasury Bill plus 4% (Historically between 6% – 8% annualized; however, we expect our target to move higher to reflect that rates will increase above their levels from the previous 10 years.) over a full market cycle, generally 7 to 10 years, while maintaining a lower risk profile than the broad U.S. stock market as measured by the Russell 3000 Index. The fund seeks to achieve this goal by dynamically allocating investments across asset classes and geographies, primarily through investing in exchange traded funds (“ETFs”). The Fund may also invest in proprietary strategies that are developed and managed by Delphin Investments, where appropriate. These proprietary strategies may invest in public securities, illiquid and/or private securities in Frontier & Developing Markets, and active and/or newly launched passive strategies.

We believe that relative performance among asset classes deviates from equilibrium levels in the short-term, creating opportunities to add alpha by considering relative attractiveness across asset classes.

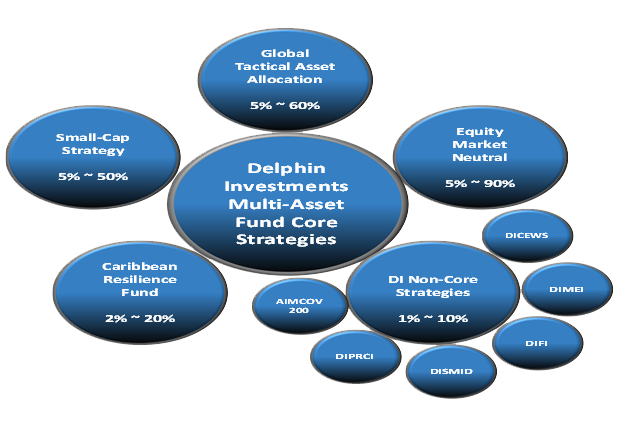

The Investment Manager intends to incorporate all internally managed strategies within its Multi-Asset Fund to achieve its investment objective. Each core strategy will have a minimum allocation of 2% of the Fund’s assets (as valued at the time of purchase), except during extreme risk-off/risk-on market environments. Non-core strategies will have a minimum of 1% of the Fund’s assets and a maximum of 10%.

DMAF Strategic Asset Allocation

Delphin Investments’ Equity Market Neutral (DIEMN)

Delphin Investments’ Equity Market Neutral (DIEMN), launched in December 2011 and in 2012 was registered as “Salt & Pepper Fund”, generally comprises 200-300 long and 200-300 short positions. As of October 2021, we have closed the Salt & Pepper Equity Market Neutral Fund in Cayman Island and now this strategy is offered through a separately managed account (SMA) only, if desired by an investor, the fees are 1 and 20. While DI has closed the Sαlt & Pepper Market Neutral Equity fund; the strategy continues to have a track-record as it a strategic allocation for our dedicated equity risk mitigation within the Delphin Multi-Asset Fund (“DMAF”).

Hybrid Model: Proprietary quantitative screens with complementary layers of macro research and fundamental analyses to provide superior risk-adjusted results through various market and economic cycles.

A Combination of Core Models and Opportunistic Overlay to Reduce Volatility

Objective: Seeking equity-like returns with downside protection using a liquid strategy that is negatively correlated to equity markets.

Implementation:

✓ Core models take advantage of market inefficiencies that cause specific stocks to be underpriced or overpriced.

❖ Liquidity Strategy: Exploits the liquidity premium among listed public equities that are not widely traded.

✓ Fundamental research confirmation and macro analyses overlay are used to complement and enhance the core models by minimizing portfolio volatility and drawdown.

Risk Control: Disciplined. With defined flexibility to minimize down-side risk while providing consistent alpha. The strategy has risk (volatility) characteristics similar to a U.S. bond portfolio as well as the HFRI FoF Market Defensive Index, while providing exposure to some of the upside of equity markets with significantly less downside. Our monthly correlation since inception (through 2021) is 0 versus the HFRI FoF Market Defensive index and negative versus the S&P 500, Russell 3000 and HFRI Equity Market Neutral indices at -0.46, -0.45 and -0.11, respectively.

Delphin Investments’ Caribbean Resilience Fund (“CRF” or the “Fund”)

✓ Small and medium enterprises (“SMEs”) operating in countries in the Caribbean and Central America (see the pan-Caribbean region

description in the Appendix) where, oftentimes, businesses can benefit from a growing middle class;

✓ Opportunities in countries where policy reset (i.e. – improved quality of local governance and macroeconomic management) may reinvigorate

growth and economic potential; and

✓ Opportunities in markets where the Delphin Investments and/or affiliates already have trusted relationships and contacts.

✓ CRF targets a blended return of 12% to 15% (Fund NAVs calculated quarterly)

✓ The Fund intends to achieve its objective by investing in a diversified set of SMEs that are either:

a) based in the pan-Caribbean region or, more specifically, the Target Region (defined below);

b) originate their products significantly from the Target Region; or

c) are based globally, but generate at least 30% of their revenues from the Target Region.

❖ While certain economies in the Target Region dwarf others, the Fund anticipates maintaining prudent levels of diversification by capping the exposure to any one country at 20% of its portfolio.

❖ In order to manage liquidity while maintaining full exposure to the pan-Caribbean region, CRF will invest in a broadly diversified and

customized index of publicly traded pan-Caribbean securities (see Delphin Investments Proprietary Caribbean Region Index). The Fund’s exposure to this index will range between 0% to 25% of its portfolio.

DI Commodities Equally Weighted Strategy (DICEWS)

The DI Commodities Equally Weighted Strategy (DICEWS) investment objective is to provide long-term total return on-par with an equal-sector-weighted version of the Bloomberg Commodity Index, by investing in commodities and fixed-income instruments. The Portfolio is managed on a total

return basis, and not with an objective of achieving or avoiding any particular tax consequences.

✓ Investing in commodities and fixed-income instruments.

✓ Our proprietary strategic asset allocation favors always having exposure to real assets (including commodities).

✓ Our approach is to invest in an equally weighted basket to lower volatility.

Commodity Sectors

Precious Metals

20%

- Gold

- Silver

Agriculture

20%

- Corn

- Soybeans

- Wheat

- Cotton

- Sugar

- Coffee

- Soybean Oil

- Soymeal

- Kansas

- Wheat

Livestock

20%

- Live Cattle

- Lean Hogs

Industrial Metals

20%

- Copper

- Nickel

- Aluminum

- Zinc

Energy

20%

- Natural Gas

- WTI Oil

- Brent Crude Oil

- Heating Oil

- Low Sulphur Gas Oil

- RBOB Gasoline

AIMCOV200 Fund

AIMCOV200 Fund seeks superior risk-adjusted returns through the active management of a diversified portfolio of both equity and debt-related securities.

The Management Team will construct the Fund’s portfolio in such a way as to provide for a consistent income stream from higher yielding bonds, allow for unhindered capital appreciation potential from equities during Bull markets, and yet be flexible enough to readily adapt to changing market conditions and hence minimize downside risk in Bear markets.

The Fund will primarily focus on Midcap growth equities both long and short, as well as higher yielding bonds, some merger/arbitrage investments and Commodity ETF’s.

The Management Team looks to include equities in the Fund’s portfolio that have exhibited above average growth, are fairly priced from a valuation perspective, contain a perceived margin of safety in the close proximity of the stock price to a likely floor price, and where there is a catalyst or event that will aid future gains in earnings.

The inclusion of higher yielding discounted bonds will add additional income and appreciation to the portfolio in companies with above average

growth and strong business prospects. The management team however will focus on both relative value and pay critical attention to the margin of

safety inherent in the company’s ability to maintain uninterrupted payouts.